Citibank. Providing Citibank customers with a better online experience.

Agency

Publicis Sapient

Role

Design Lead

Output

UX strategy

UX/UI

Overview

Citibank had noticed a significant decrease in customers applying for credit cards through their online channels. Working with Publicis Sapient, we set up an agile war room on site at Citibank with the aim to improve their customers online experience, and to introduce agile and design-led methodologies to Citibank.

As a design lead I was responsible for the creative output, leading a team of UX, copywriters and analysts through the design process.

The war room

Introducing a Different Way of Working

The onsite war room was the team’s home for the next 6 months, this is where our team worked collaboratively with Citibank product owners and stakeholders.

We planned our project roadmap over six sprints, with the team running a series of incremental tests across each sprint.

When we set up the war room and discussed the focus, it wasn’t just about the test results, the bigger part of the exercise was to demonstrate how a design-led way of working could operate inside the bank. Although we wanted our tests to win, the focus was to show corporate businesses that their strategy can be design-led. By adopting design-thinking methodologies, the process would drive the results.

We customised our design process to suite the programme initiative and choose to focus on 4 key stages. Having the process clearly defined helped set expectations with the client and served as a catalyst for decision-making throughout the 6 months.

The discovery

Citibank Immersion

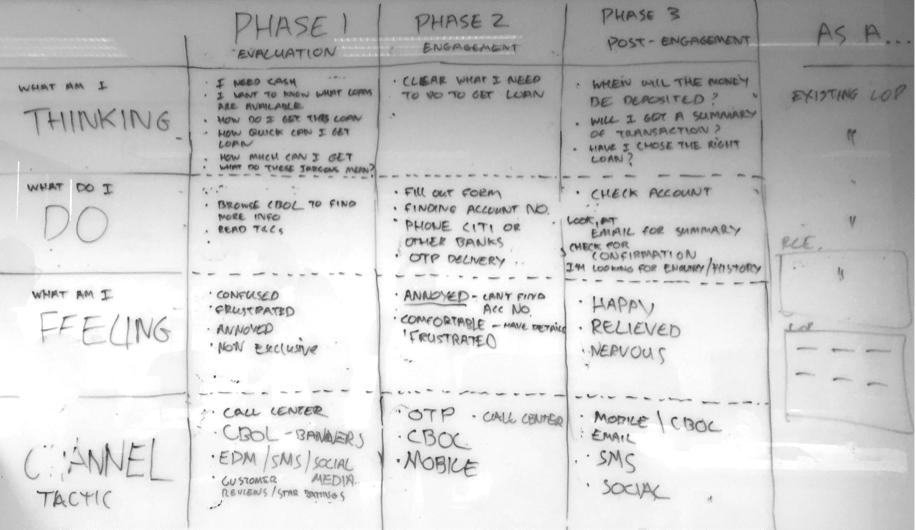

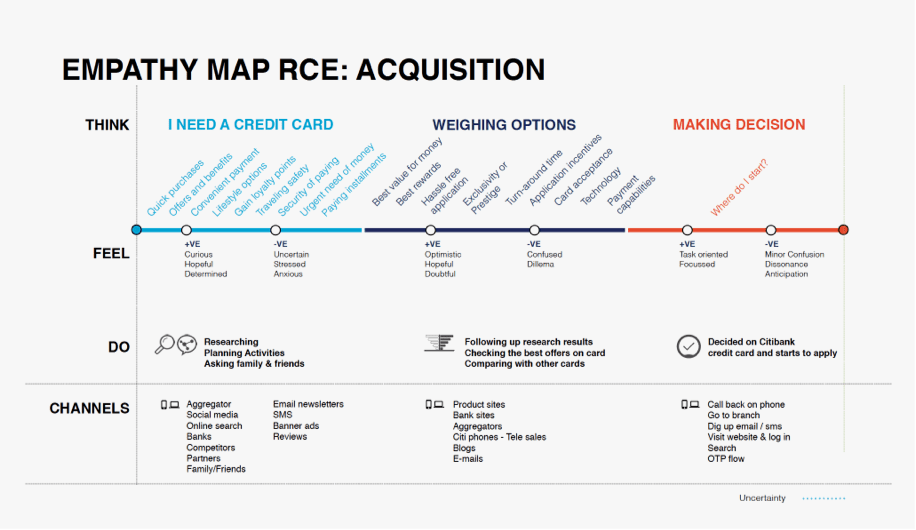

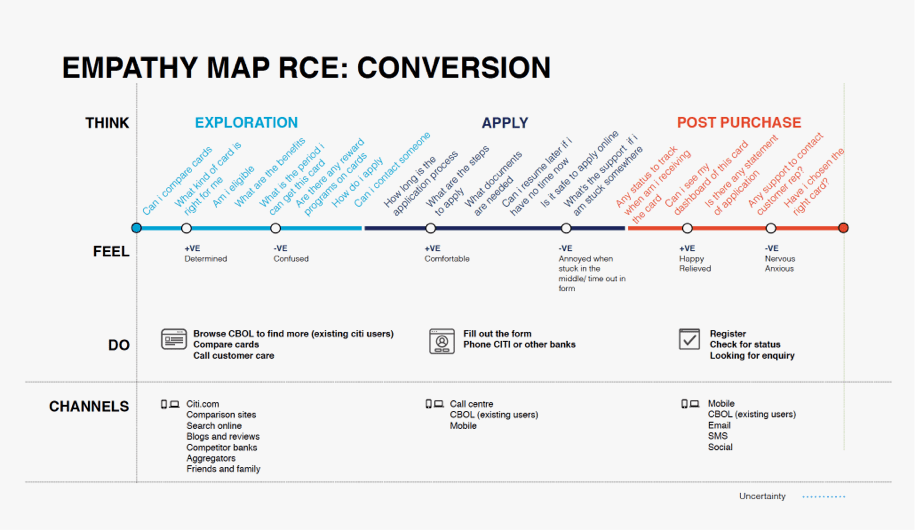

We kicked-off with stakeholder interviews to learn about existing products, and to help us understand the business challenges and current ways of working. We followed up with an empathy mapping workshop to learn about the customers, their goals, motivations, and frustrations when applying for credit cards online.

From this, we defined two areas of focus – pre-application (acquisition) and during application (conversion) and collated the findings into empathy maps.

The process

Learning through first hand experience

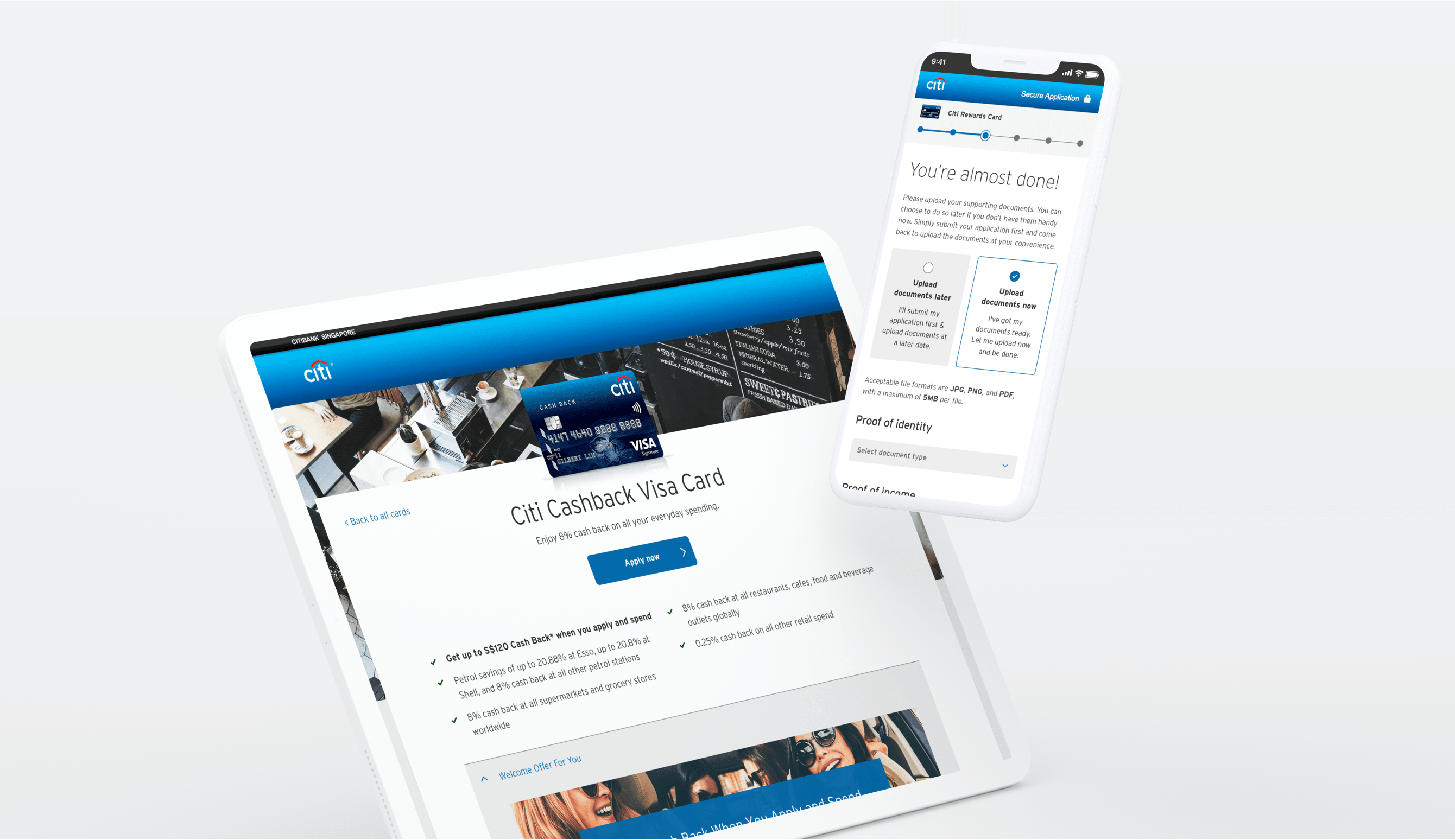

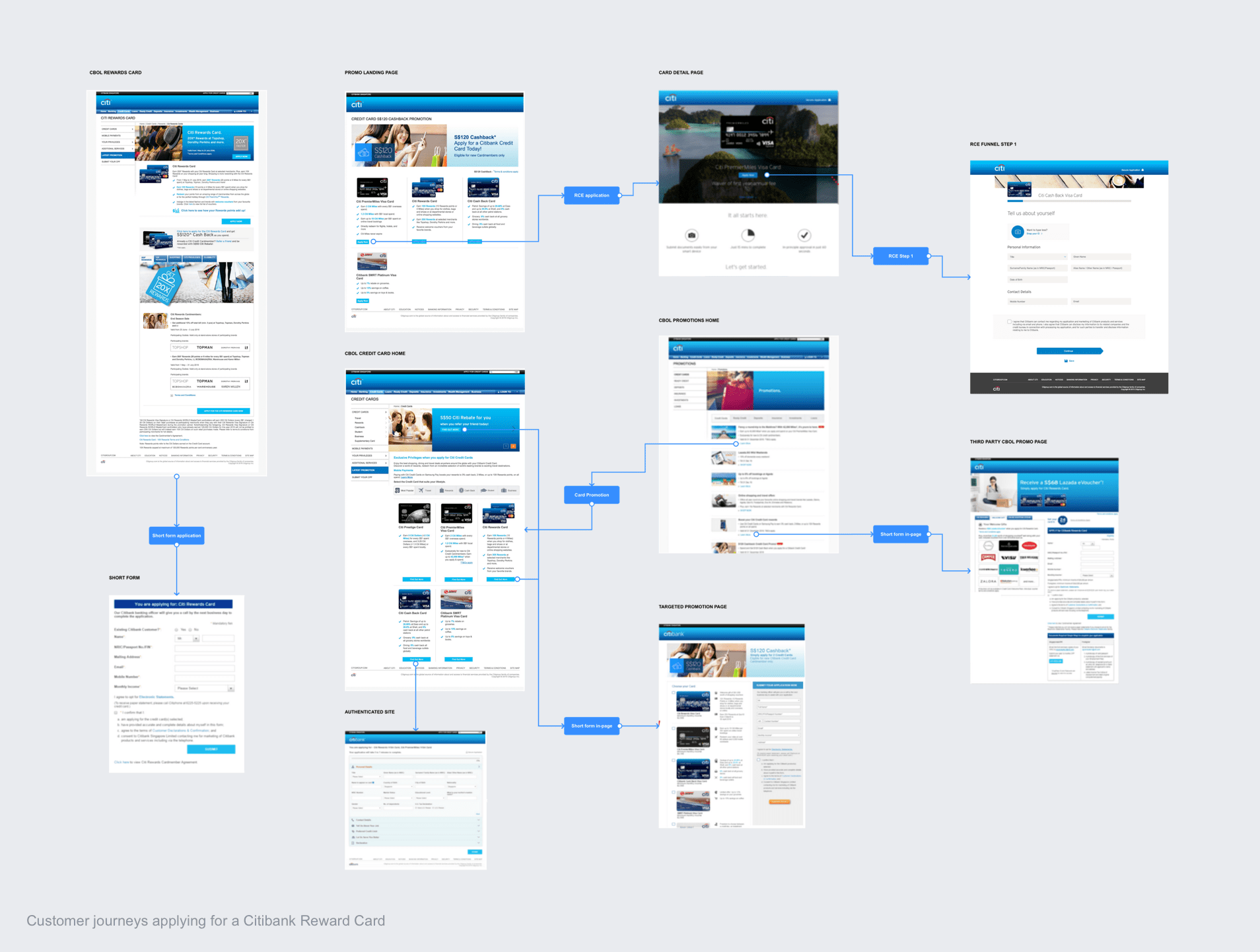

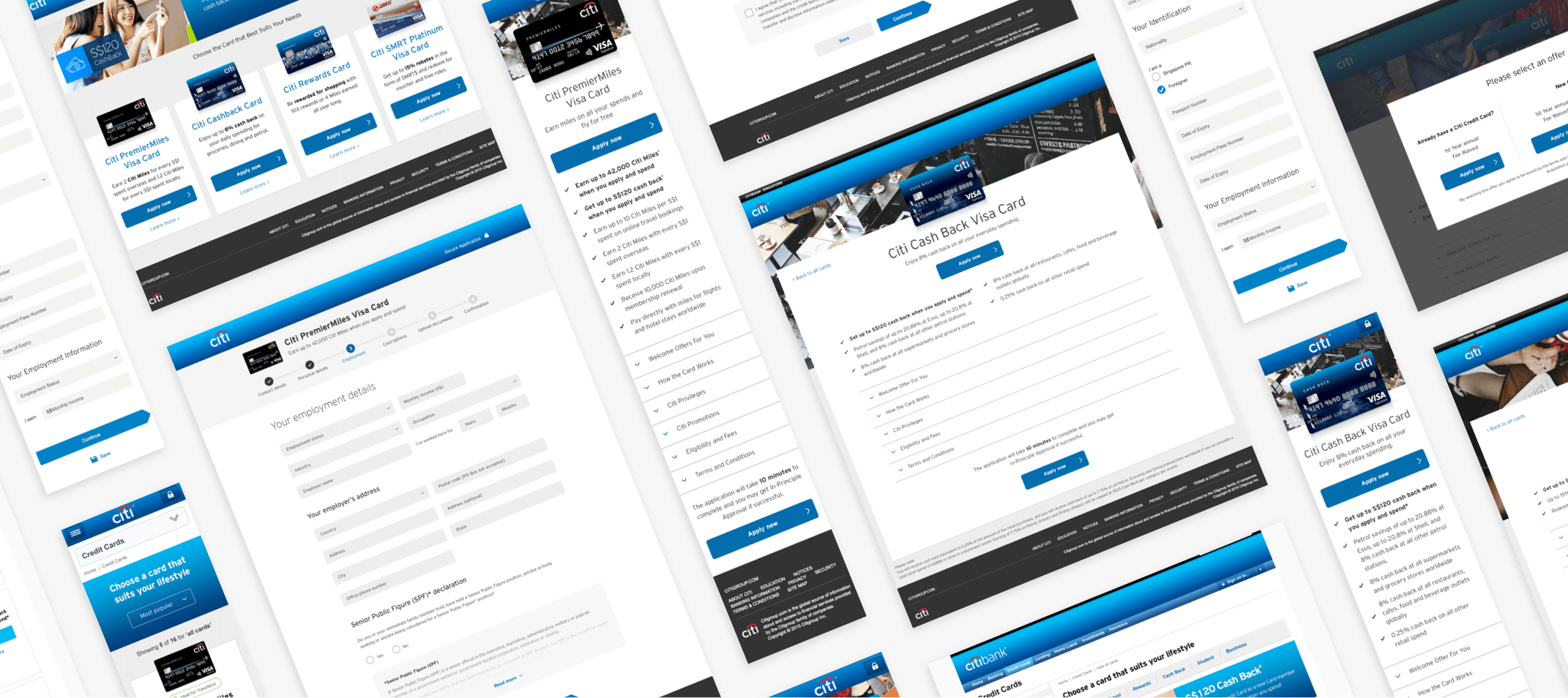

For a more holistic understanding of the challenges potential Citibank customers had when signing up for a credit card, we set up online test accounts and went through all the possible customer journeys, paying particular attention to the information architecture, editorial content and visual design. This helped me understand the scale and complexity of the problem and enabled me to prioritise the areas for the team focus on.

Identifying areas of impact

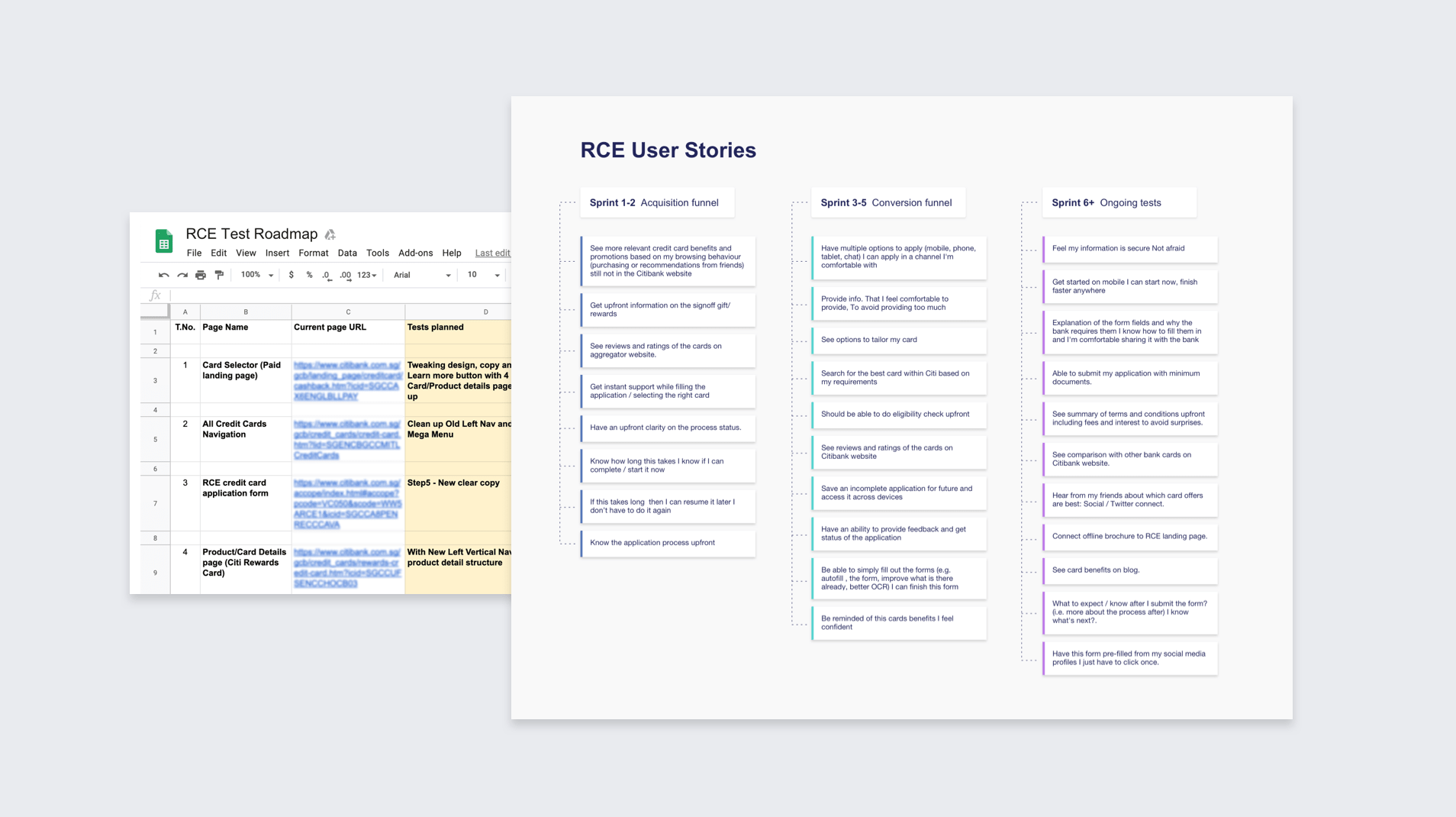

User stories were created to cover all areas we wanted to focus on across acquisition and conversion, and then prioritised based on the impact to the business and the ease of implementation. From this, I created a series of tests which we split across each sprint.

Ideation

Optimising the Customer Journey

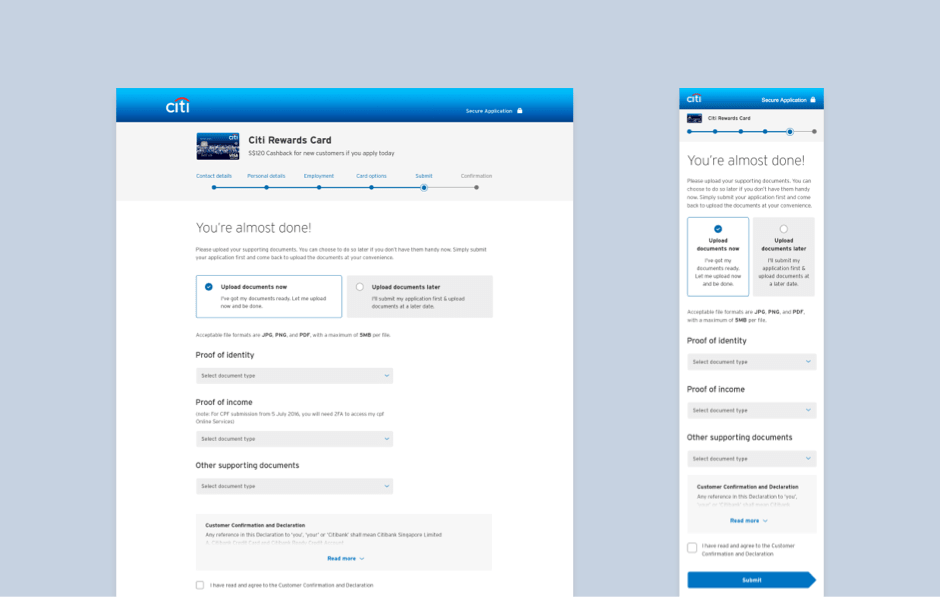

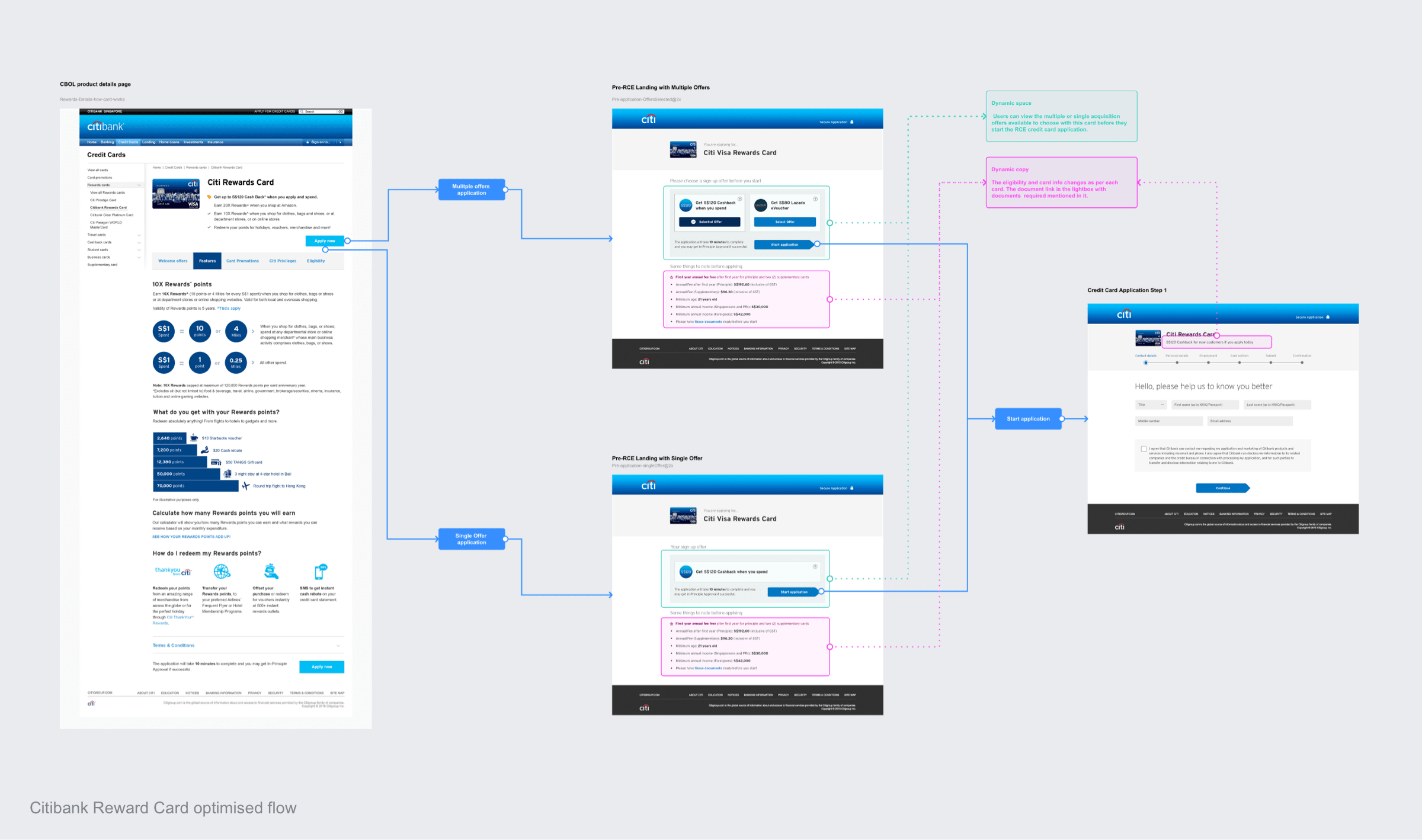

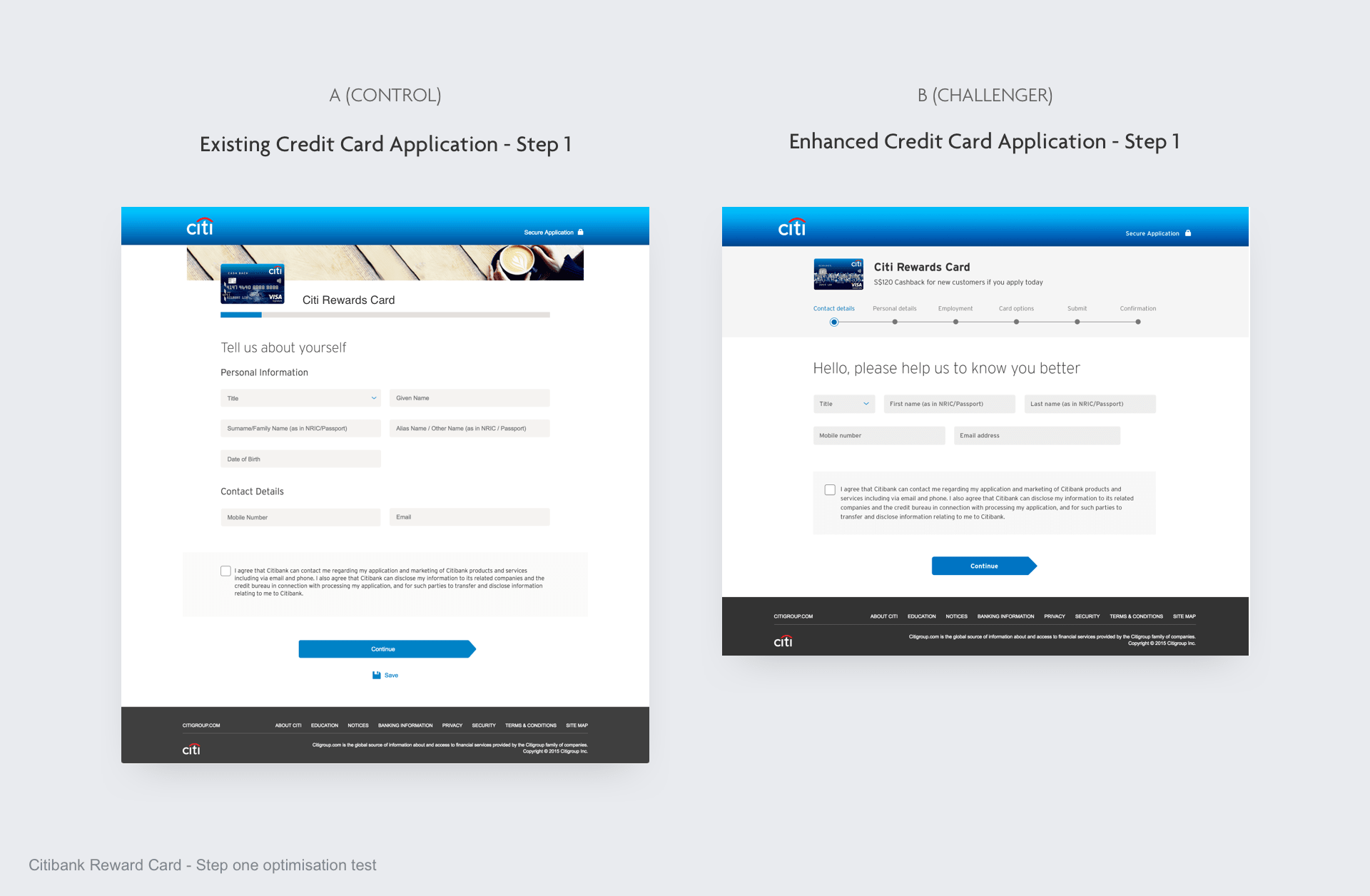

Each test was examined in detail, using quantitive data from analytics to help inform our design decisions. The tests varied from small tweaks to editorial and visual content, through to large scale architectural changes across entire flows.

Throughout the design process we sketched and prototyped possible solutions and worked with product stakeholders, internal development teams and the Citibank creative team to refine the content and plan implementation.

Validation

Going for the win

All tests were focused on the Singapore market using an A/B testing approach and ran for a predefined amount of time. Tests which required more insights and validation were pushed out to the other APAC regions like Hong Kong and Malaysia where we found cultural behaviours and attitudes to credit cards and finance could influence the test results.

The impact

Over the 6 months we completed a total of 48 tests with another 15 still running through affiliate partner sites (paid) and ongoing tests in other APAC markets. We had 71% test success rate, with the successful tests being pushed out as enhancements across all APAC markets (Australia, China, Malaysia, Hong Kong, Philippines).

48

Tests

71%

Success rate

14%

Increased conversion rate through affiliate partner sites (to date)

Key learnings

The agile approach gained positive recognition from the wider business, and the war room was positively supported by the teams that worked with us.

One of the biggest challenges throughout the process was to constantly drive the importance of a customer-first approach. Outside of the war room, most teams operated in a waterfall model where success is measured through hitting specific business targets, with less focus on customer needs.

As we started to complete the tests successfully, we gained recognition of the potential business value in the agile approach.

Next project